Non-Collection of Taxes with IDs in "Applied for" Status & Tax Validation

Namely is updating its tax collection process with regard to tax IDs required for us to remit payments to the appropriate tax jurisdictions. Specifically, Namely will no longer collect taxes with IDs in an “applied for” status.

BACKGROUND

As part of our Payroll offering, Namely can remit taxes on behalf of your organization provided we have the required tax ID of the jurisdiction in which those taxes are owed (and any other information required by the jurisdiction). If you’re in the process of setting up new taxes for your organization but still waiting to receive tax IDs from new jurisdictions, Namely allows you to note that the ID has been “applied for” by:

-

Navigating to Payroll > Company > Tax > Add Tax.

-

Selecting the Waiting for Tax ID option.

Previously, we would collect taxes for jurisdictions in which an ID had been applied for. However, if the ID was not entered in Namely by the time the tax came due, we were unable to remit it to the tax agency. In this case:

-

Taxes remitted on a quarterly basis would be refunded to the client, who would then be responsible for submitting the payment to the tax agency. These late payments would be subject to tax agency penalties and interest.

-

Taxes remitted more frequently would not be refunded but would continue to incur tax agency penalties and interest because they could not be remitted to the appropriate jurisdiction.

In essence, Namely operated as a reverse savings account, collecting funds and leaving our clients with less operating cash on hand throughout the quarter, while subjecting those funds to penalties and interest charges.

To avoid this, Namely will no longer collect taxes for jurisdictions with IDs in an “applied for” status. For more information visit Non-Collection of Taxes with IDs in "Applied for" Status & Tax Validation.

TIP:

Namely cannot make payroll tax deposits or file payroll tax returns without the federal, state, and local agency assigned account numbers, payment numbers, and/or agency authorizations as directed per the individual state jurisdiction. If Namely is not provided the necessary information in a timely manner your company will be responsible for penalties and interest due to late payment(s) and late filing(s).

MOVING FORWARD

Previously, funds for uncollected tax amounts needed to be wired to Namely after a new tax ID was entered. Now, Namely automatically collects previously uncollected amounts from the current quarter on your next standard pay cycle once you enter a new tax ID. For more information visit Automatic Tax Collection for “Applied For” Tax IDs.

Once you have entered a valid ID in Namely, along with any other required tax information, we will begin to collect payments from your future pay cycles and remit them when they come due. To avoid incurring any late fees or penalties with the tax agency, we recommend providing us with this information as soon as possible, as many taxes have due dates throughout the quarter.

-

To learn how to apply for a tax ID, visit our Namely Toolkit: Tax Services.

-

To learn how to enter a tax ID in Namely, visit our Adding and Editing Company Tax Codes and Rates in Namely Payroll guide.

VALIDATING IDs

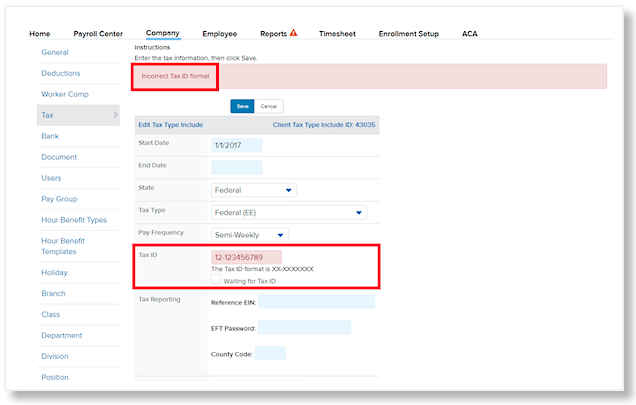

When entering tax IDs into Payroll under Company > Tax, Namely will not allow you to save the ID if it is entered in an invalid format.

Note: Namely is not able to validate whether your tax ID is correct, only whether it is in a valid format.

If you have any IDs currently entered in Namely in an invalid format, they will be highlighted in red on the Company > Tax page. Invalid IDs will not prevent you from running payroll, and Namely will continue to collect for taxes with invalid IDs, however, we won’t be able to remit those payments to the tax agency when they come due. Please enter valid IDs as soon as possible to avoid tax agency penalties and interest.

INVALID TAX ID WARNINGS

We have added the following warning messages to Namely Payroll to highlight any invalid tax IDs that are saved in your site.

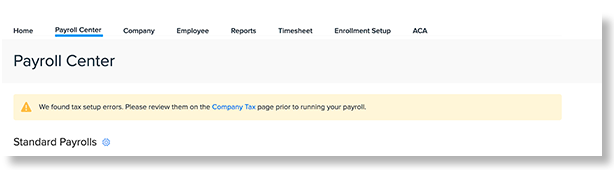

Payroll Center

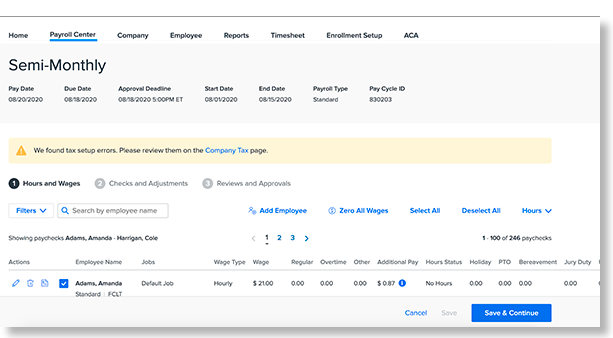

Step 1 of Payroll Processing

If you see either of these banners, go to Company > Tax page and correct any tax IDs that are highlighted in red, which indicates that they are saved in an invalid format.

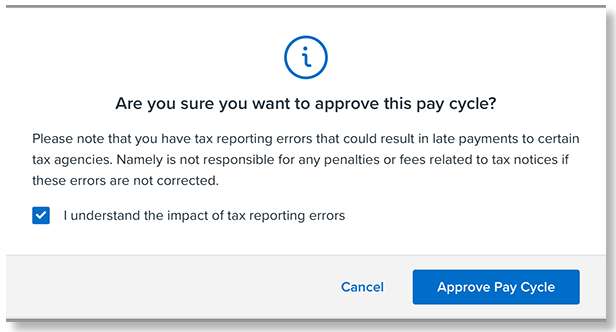

Approve Pay Cycle

If you attempt to approve a pay cycle with invalid tax IDs, you'll be prompted by the above message when you attempt to approve your pay cycle.

REMITTANCE OF NON-COLLECTED TAX PAYMENTS

Please note: Once a valid Tax ID is entered and no longer in "Applied For" status, Namely will only collect previously uncollected funds from the current quarter.

If you have already paid the uncollected funds to the agency directly, please submit a case Help Community by selecting Payroll > Taxes > Tax Services > Function > Applied for Recollection with the details of the tax you have paid, so your ‘uncollected’ tax can be updated in Namely Payroll to accurately reflect that you have paid.

Also, note that only taxes from the current quarter and onward will be filed once the tax ID is entered. If tax IDs are still in "Applied for" status at the quarter close, Namely cannot file taxes for those jurisdictions at that time.

Additionally, Namely does not automatically backfile for any missed quarters after new tax IDs are provided without your specific request. To request that Namely backfile on your behalf, submit a case in the Help Community by selecting Payroll > Taxes > Tax Services > Function = Applied for Recollection.

Be aware that certain situations may also still require you to wire funds to Namely once tax IDs are entered, including:

-

Uncollected amounts remain from previous quarters.

-

No scheduled pay cycles are left in the current quarter when you enter a new tax ID.

To locate amounts owed:

-

In Namely Payroll, go to Reports > Date Range.

-

Select the current Year.

-

Note: If you have unpaid balances from previous years, they will not be included in this report.

-

-

Run the Payroll Summary report. The amount owed will appear in the Uncollected Taxes (Due to Missing Tax Filing Information) section. You will need to run this report by quarter in order to properly populate the required template.

-

Use the instructions in this article to wire the funds to Namely. Please add a memo or remark in the wire description with your company name and the tax jurisdiction(s) for which you are wiring funds.

TIP:

To ensure correct application of the wire funds you will need to fill out the Uncollected Tax Template for Wires and attach it to your request.

REPORT UPDATES

In conjunction with the above changes, we've updated a number of payroll reports to help you surface any uncollected payments you may owe.

Payroll Register

In the Payroll Register report, the Uncollected Taxes section will be broken out to further specify why taxes are not being collected. The reasons why taxes would not be collected are either:

-

Missing Tax Filing Information

-

Deferment of Taxes (due to COVID-19)

Cash Requirement Report

Under the Not Collected By Namely section, we will be breaking out calculations based on two new factors.

-

Missing Tax Filing Information

-

Deferment of Taxes (due to COVID-19)

Payroll Summary

A new section has been created called Employee Uncollected Taxes not filed by Namely, which includes the following taxes:

-

NY-SDI

-

HI-SDI

-

WA-L&I

-

NY-PFL

Two additional new sections have been created, where we will be breaking out calculations based on two new factors.

-

Missing Tax Filing Information

-

Deferment of Taxes (due to COVID-19)

FREQUENTLY ASKED QUESTIONS

APPLYING FOR AND ENTERING TAX IDS

Where can I see a list of all of my missing tax IDs?

Please go to Company > Tax in Payroll to view all of your tax jurisdictions. In the Tax ID column, any tax that reads Applied For is missing a tax ID.

I’m not sure how to apply for my current “applied for” tax IDs. Do you have any more information?

Yes. Please visit our Namely Toolkit: Tax Services Help Community article for more details on how to register for state tax IDs. You can also purchase Tax Registration Services, where Namely can apply for tax IDs on behalf of your organization. (Please note, this does not include additional information, such as third party administrator access, which may also be required to remit taxes). For more information on how to subscribe to our Tax Registration Services, please navigate to our Project Service Catalog.

I have an invalid tax ID in Namely Payroll. Where can I find my tax ID number?

You will need to refer to any documentation that has been sent to your organization from that jurisdiction. For more details on how to find and register for your state tax ID, please visit our Namely Toolkit: Tax Services Help Community articles.

I have an “applied for” tax ID for state income tax with a semi-weekly pay frequency. How long do I have to apply for a tax ID and supply it to Namely without accruing penalties and interest?

Please enter your tax ID into Payroll as soon as possible. Remittance due dates may have passed already and you may have incurred penalties and interest as a result of late payment. Please note, Namely will not be notified if your organization is liable for penalties and interest. Please refer to any correspondence from the jurisdiction(s) in question for penalties and interest accrued and payment options.

Can Namely apply for tax IDs on behalf of our organization?

If you subscribe to Namely’s Managed Payroll or purchase Tax Registration Services, then Namely can apply for tax IDs on behalf of your organization. (Please note, this does not include additional information, such as third party administrator access, which may also be required to remit taxes). For more information on how to subscribe to our Tax Registration Services, please navigate to our Project Service Catalog, and for our Managed Payroll offering, please email clientsales@namely.com.

For all other clients, it is your responsibility to provide tax IDs to Namely in order to ensure timely remittance of your company taxes, and to avoid penalties and interest.

What will happen if I try to save a new tax ID in an invalid format?

If you try to save a new tax ID in an invalid format, an error will pop up that says "Incorrect Tax ID Format", and you will not be allowed to save. The valid formats of all tax IDs are displayed when selecting the tax that you are trying to add.

I’m not allowed to sign up for a tax ID until I run a payroll. What do I do in those situations?

Agencies need to provide a tax ID prior to payroll. Otherwise, tax filing and remittance can be late upon running payroll. If you are unable to get the tax ID in time, you will need to wire your funds for that jurisdiction, as Namely will not have collected for those taxes during the first pay cycle.

If I have an invalid tax ID, can I still process payroll?

Yes. You can still process payroll and Namely will collect for those taxes if you have an invalid tax ID saved, however, Namely will not be able to remit taxes on behalf of your organization if you have an invalid tax ID. Additionally, when processing a payroll, you will see a banner in Step 3 of Payroll and a pop up when you are approving a pay cycle to inform you of the invalid tax IDs that are currently saved in your Namely Payroll site.

If we do not have any “applied for” or invalid tax IDs, is any action required?

No. If all of your company taxes have valid tax IDs, no action is required.

I understand that certain tax IDs for select jurisdictions match our Federal Employer Identification Number (FEIN). Can Namely file taxes on our behalf for any jurisdiction if we just add our FEIN, instead of “applied for”?

No. While the tax ID of some specific jurisdictions is simply an employer’s FEIN, this does not apply to all tax jurisdictions. In fact, most tax jurisdictions require a unique tax ID that is different from your FEIN. If you are waiting for a tax ID from any jurisdiction, please select “Waiting for Tax ID” and for any pay cycle that you process with an “applied for” tax ID, please wire your funds to Namely by following the steps outlined in our Help Community Article.

COLLECTION & REMITTANCE

If Namely has previously been collecting for an “applied for” tax ID we already have in the system, will they continue to collect for that tax ID?

No. Namely will no longer be collecting for any taxes that have an “applied for” tax ID.

If Namely has already collected for “applied for” taxes this quarter, will Namely be refunding that money?

For taxes with a quarterly pay frequency, like state unemployment insurance, if Namely has collected funds for “applied for” taxes this quarter, and you do not have a tax ID by the end of the quarter, Namely will be remitting those funds to your organization.

If I still want Namely to collect funds for any “applied for” taxes, is that an option?

No. As of August 6, 2020, Namely no longer collects for any taxes with an “applied for” status. This new behavior aligns with industry best practices, as Namely will not be collecting for any taxes that we are unable to remit and will clearly identify what information is missing that is preventing us from doing so. By clearly and quickly obtaining any missing information, you will be avoiding potential penalties and interest.

What will happen if I currently have an invalid tax ID number saved in my Namely Payroll site?

If you currently have an invalid tax ID saved in Namely Payroll, that tax will be highlighted in red under Company > Tax. Please note, Namely will continue to collect for those taxes, but we cannot remit any taxes with an invalid tax ID. It is crucial that you update any invalid tax IDs as soon as possible in order to avoid penalties and interest.

If I have an invalid tax ID, will Namely still be able to remit taxes on behalf of our organization?

No. Without a valid tax ID, Namely will not be able to remit taxes on behalf of your organization, and penalties and interest could accrue for late payment. This behavior has not changed.

WIRING FUNDS

Once we have a tax ID, can Namely automatically debit our account for any funds owed, rather than requiring a wire?

Namely will begin debiting you for taxes that you enter an ID for on any future pay cycles but will not retroactively debit for past pay cycles where the ID was still in "applied for" status. You will still need to wire any taxes owed from past pay cycles prior to entering your tax ID into Namely Payroll.

Once I have my tax ID, how do I find out the amount that I need to wire to Namely?

If you want Namely to remit any payments that were not collected while a tax was in “applied for” status, those funds will need to be wired to Namely. To locate amounts owed:

-

In Namely Payroll, go to Reports > Date Range.

-

Select the current year for the Year.

-

Note: If you have unpaid balances from previous years, they will not be included in this report.

-

-

Run the Payroll Register report. The amount owed will appear in the Uncollected Taxes (Due to Missing Tax Filing Information) section.

-

Use the instructions in this article to wire the funds to Namely.

How do I wire my funds to Namely?

Please use the Namely Treasury Bank Wire Form found in the following Help Community Article. Please add a memo or remark in the wire description with your company name and the tax jurisdiction(s) for which you are wiring funds.

If I subscribe to Namely’s Managed Payroll offering, will I ever need to submit a wire for uncollected taxes?

There could be circumstances in which Namely will require a wire for uncollected taxes due to timing. For example, if an employee is hired in a new jurisdiction one day before processing your payroll, there is a chance that there will not be enough time for Namely to apply for the tax, and for the agency to respond with a tax ID before your payroll is processed. In that scenario, Namely will require a wire for that jurisdiction, as taxes would not have been collected. Namely will alert you should this occur. You can find instructions for determining uncollected tax amounts, as well as wiring the funds to Namely here.

If I subscribe to Namely’s Tax Registration Service offerings, will I ever need to submit a wire for uncollected taxes?

There could be circumstances in which Namely will require a wire for uncollected taxes due to timing. For example, if an employee is hired in a new jurisdiction one day before processing your payroll, there is a chance that there will not be enough time for a request to be submitted in our Project Service Catalog, for Namely to apply for the tax, and for the agency to respond with a tax ID before your payroll is processed. In that scenario, Namely will require a wire for that jurisdiction, as taxes would not have been collected. Namely will alert you should this occur. You can find instructions for determining uncollected tax amounts, as well as wiring the funds to Namely here.

Where can I find more information on state tax IDs?

Please navigate to our Namely Toolkit: Tax Services Help Community articles for more details on how to register for state tax ID

Why do I have to wire? Why can’t I just debit it? My taxes aren’t due for a month and my debit will be there in time.

In order to ensure that we have sufficient funds to remit your taxes, and to guarantee a timely remittance, funds must be wired to Namely using the form located in this article.

OTHER

Why change this process now?

In our continuous efforts to improve our client experience, we wanted to ensure that the tax collection and remittance process is clear. We had received feedback that since we were previously collecting funds for “applied for” tax IDs, that often led to confusion when taxes were due, since Namely could not remit without a tax ID. This update clarifies the tax collection process, and highlights any missing tax information immediately, drastically reducing the risk of tax notices, penalties and interest.

Which taxes have been filed and which haven’t? Where are the confirmation numbers?

For more information regarding your organization’s confirmation numbers for tax filing, please submit a case in the Help Community using the product name Payroll and the subject Tax Filing Confirmation Numbers.

Certain states allow you to remit and file without a tax ID. Why do I have to give you the ID now?

Any tax that Namely remits or files on behalf of your organization needs to have some sort of registration ID, even if that ID number is simply your Federal Employer Identification Number (FEIN).